south dakota sales tax rate changes 2021

For tax rates in other cities see South Dakota. 2022 List of South Dakota Local Sales Tax Rates.

Growing Number Of State Sales Tax Jurisdictions Makes South Dakota V Wayfair That Much More Imperative Tax Foundation

The St Charles sales tax rate is.

. Did South Dakota v. State State Sales Tax Rate Rank Avg. Mitchell was collecting a.

12-01-2021 1 minute read. February 2022 512 changes November 2021 86 changes Over the past year there have been 982 local sales tax rate changes in states cities and counties across the United States. Ad Lookup State Sales Tax Rates By Zip.

The maximum local tax rate allowed by. This is the total of state county and city sales tax rates. 45 Municipal Sales Tax and Use Tax Applies to all sales of products and services that are.

Municipal governments in South Dakota are also allowed to collect a local-option sales tax that. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933.

The County sales tax rate is. Local Sales Tax Rate a Combined Sales Tax Rate Rank Max Local Sales Tax Rate. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

The South Dakota sales tax rate is currently. What Rates may Municipalities Impose. The base state sales tax rate in South Dakota is 45.

Find your South Dakota. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. All South Dakota municipal sales tax rates will remain the same on January 1 2021.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which. Counties and cities can charge an additional local sales tax of up to 2 for a maximum. Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax.

Free Unlimited Searches Try Now. 31 rows The state sales tax rate in South Dakota is 4500. State.

Who This Impacts Marketplace. The South Dakota Department of Revenue administers these taxes. 45 Municipal Sales Tax and Use Tax Applies to all sales of products and services that are.

South Dakota Taxes and Rates State Sales Tax and Use Tax Applies to and services. Over the past year there have been ten local sales tax rate changes in South Dakota. The Richland sales tax rate is.

As of March 1 2019 marketplace providers who meet certain thresholds must obtain a South Dakota sales tax license and pay applicable sales tax. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65.

Average Sales Tax With Local. South Dakota Taxes and Rates State Sales Tax and Use Tax Applies to and services. With local taxes the total sales tax rate is between 4500 and 7500.

06-01-2021 1 minute read Beginning July 1 2021. South Dakota has recent rate changes Thu Jul. Download tax rate tables by state or find rates for individual addresses.

Beginning January 1 2022 the town of Lane is implementing a new municipal tax rate from 0 percent general sales and use tax rate to 2.

Sales Tax Laws By State Ultimate Guide For Business Owners

Minnesota Sales Tax Calculator And Local Rates 2021 Wise

New Municipal Tax Changes Effective January 1 2022 South Dakota Department Of Revenue

State Income Tax Rates And Brackets 2021 Tax Foundation

City Of Round Rock Suit Against Texas Comptroller Challenges New Rule Definition Of A Sale S Location Community Impact

How Nc S New Tax Cuts Will Save Taxpayers Billions

South Dakota Sales Tax Rates By City County 2022

Virginia S Grocery Tax Becoming Hot Topic In Governor S Race Wvtf

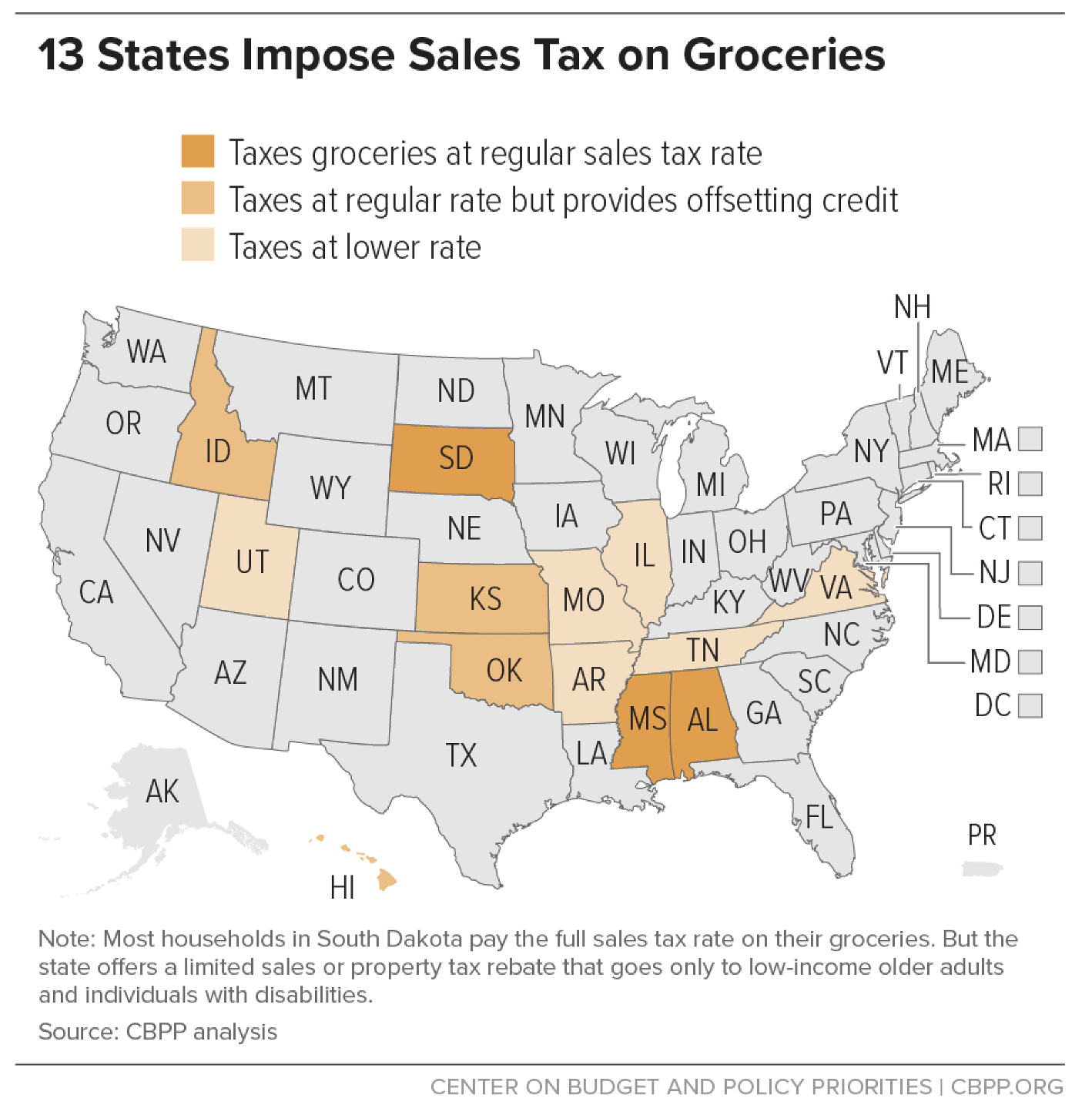

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

How To Calculate Payroll Taxes Tips For Small Business Owners Article

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Sales Tax Collection Increase In 2020 Gardnernews Com

Small Business Tax Rate 2021 Guide For Business Owners

S D House Strips State Sales Tax Off Food Keloland Com

Sales Tax By State Is Saas Taxable Taxjar

The Impact Of The U S Supreme Court S Decision In South Dakota V Wayfair The Cpa Journal

Democrats Persuade Noem To Promise Food Tax Repeal Smith Winning Dakota Free Press