fsa health care contribution

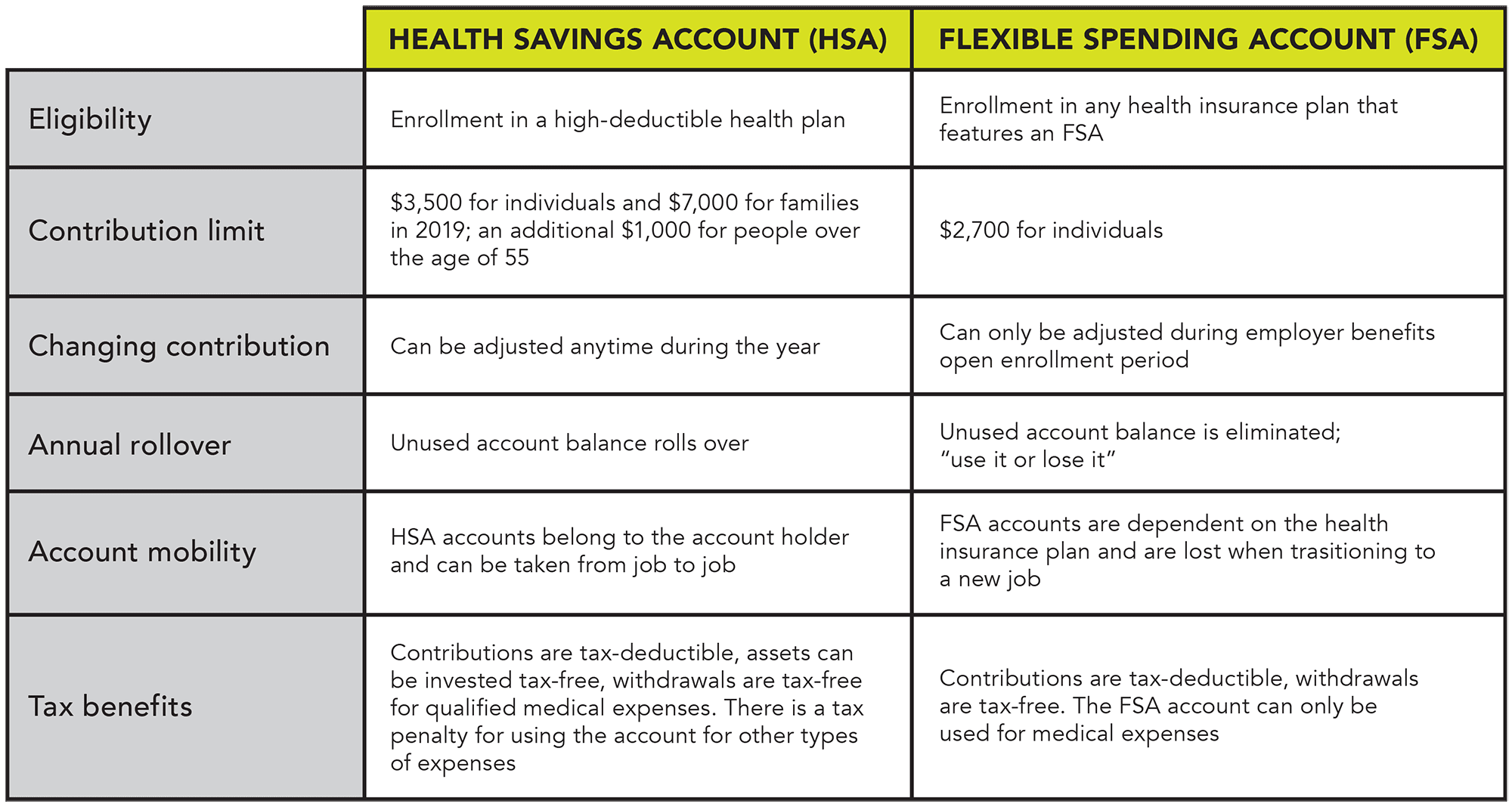

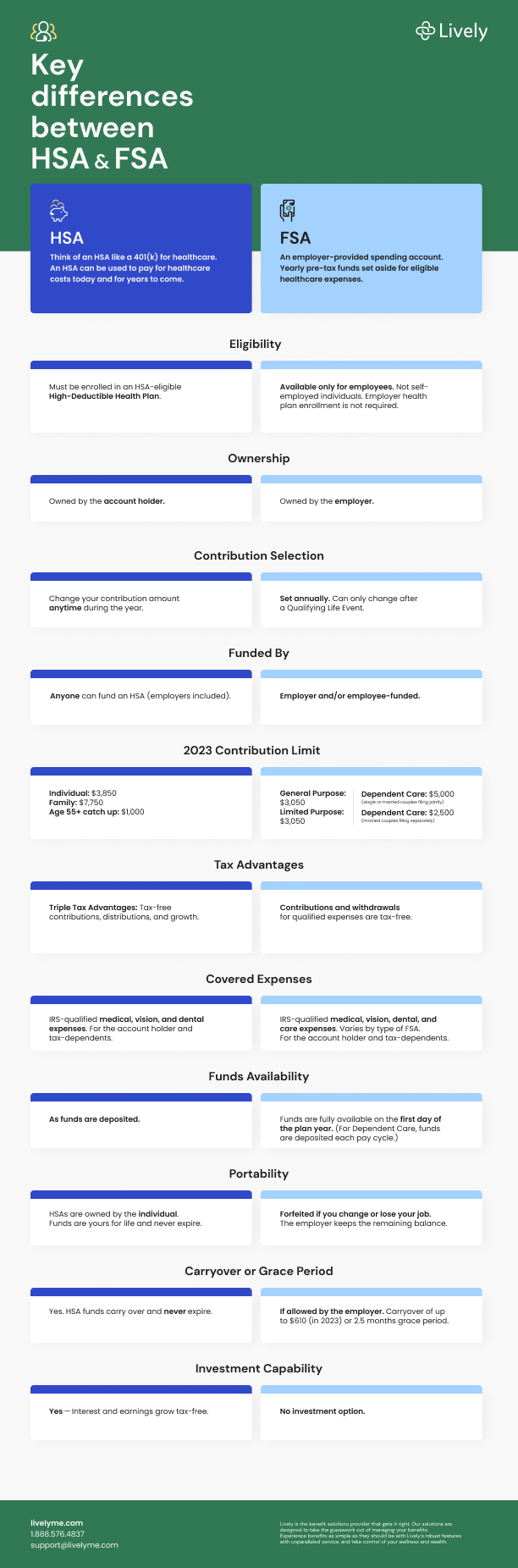

Enrollment is required each year to participate. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

Fsa Health Contribution Cap Increases To 2 850 For 2022 Hr Works

So its very simple.

. Generally health insurance plans that an employer deducts from an employees gross pay are pre-tax plans. Less than 7000000 Annual Base Salary. But thats not always the case.

Your total annual Health Care FSA contribution amount is available immediately at the start of the plan year. Health Care Flexible Spending Account BU Contribution. Please logon again to the website.

18 as the annual contribution limit rises to 3050 up. The health care Flexible Spending Amounts changed from 2850 to 3050 in maximum salary deferral contribution compared to last year. This account does not cover medical expenses for your.

New health plan contribution rates will. Annual contribution limits. With a Health Care.

For tax purposes as described in Publication 502 for example medical insurance premiums are not eligible for Health Care Spending Account reimbursement. Increasing to 500 single1000 family. As a result the IRS has revised contribution limits for 2022.

A dependent care account is similar to a medical account except its for paying daycare expenses. If youre married and both you and your spouse have an FSA. The maximum contribution for a Dependent Care FSA is 5000.

Here are the maximum. Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to 2850. There are two different types of FSAs.

On October 18th in response to rising inflation the IRS announced that the healthcare FSA annual contribution limit will increase to 3050 from 2850 in 2023 adding. The 2023 annual contribution limit is 3050. The IRS announced that for plan year January 1 through December 31 2022 federal employees can contribute 100 more into their health care flexible spending account.

Carry over up to 57000 from one plan year to the next when you re-enroll in a Health Care FSA - theres virtually no risk of losing your hard-earned money How You Save. On Tuesday October 18 the Internal Revenue Service IRS announced the health flexible spending account FSA maximum for 2023 as part of Revenue Procedure 2022-38The. 2022 Health FSA Contribution Cap Rises to 2850 Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll.

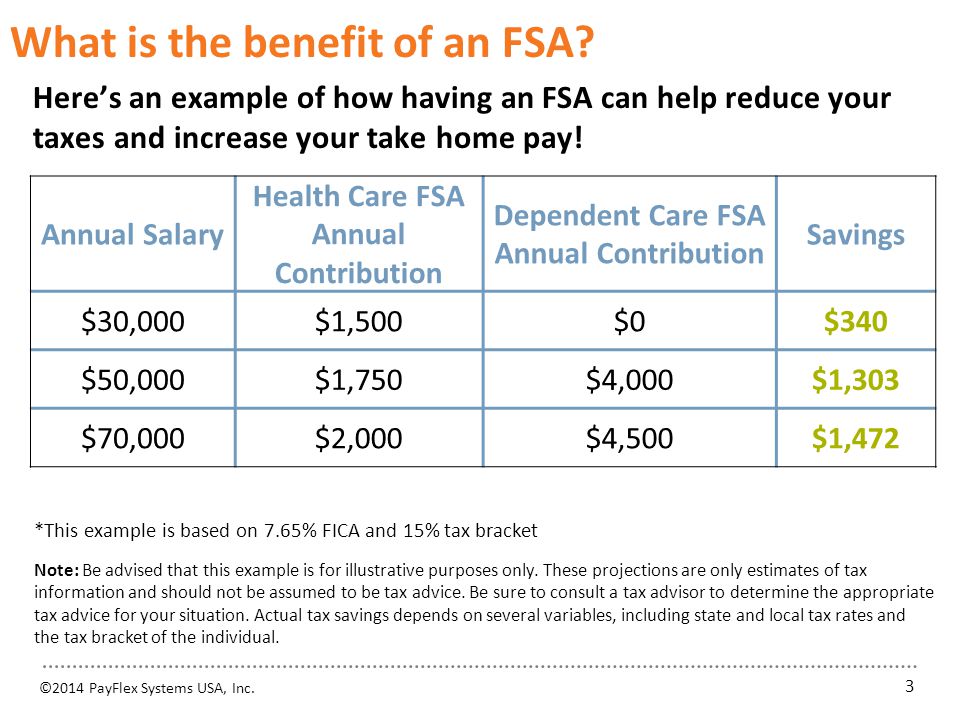

For example if you earn 45000 per year and allocate 2500 to your FSA for health care. The 2021 plan year maximum contribution for a General Purpose or the Limited Purpose Health Care FSA is 2750 per year. Your full annual election amount is available starting January 1 2023.

Health Care Spending Account. Advantage - Session Expired Your session has expired due to inactivity. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year.

You can contribute up to 2750 in 2021 and 2850 in 2022 into your Healthcare FSA. While shopping for health benefits. E mployees can put an extra 200 into their health care flexible spending accounts health FSAs next year the IRS announced on Oct.

Both FSAs were designed to help employees set aside. Note if your and your spouses employers both offer an FSA you may each be able to set up your own account and contribute up to the maximum amount each. One for health and medical expenses and one for dependent carechildcare expenses.

To utilize funds from your. You can carry over up to 570 remaining in your account from one plan year to the. Employees in 2023 can contribute up to 3050 to their health care flexible spending accounts FSAs pretax through payroll deductiona 200 increase from 2022the.

Health Care Fsa Contribution Limits Change For 2022

This Presentation Covers Ppt Download

Can I Change The Amount I Contribute To My Fsa Mid Year

Understanding The Year End Spending Rules For Your Health Account

Health Care Fsa University Of Colorado

Irs Releases Fsa Contribution Limits For 2021 Primepay

What Is An Fsa Definition Eligible Expenses More

Plan Limits Employee Benefits Corporation Third Party Benefits Administrator

What Is A Flexible Spending Account Clydebank Media

Hsa Vs Fsa Comparison Chart Aeroflow Healthcare

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Hsa Vs Fsa What S The Difference All About Vision

Hsa And Fsa Accounts What You Need To Know Readers Com

What Is An Fsa Your Guide To Flexible Spending Accounts

Charlotte Savings And Spending Accounts

Hsa Vs Fsa Which One Should You Get District Capital

Employees Contribute To Pay Through Flexible Spending Accounts Fsa Mercer Us